Clearing Up the Misinformation Surrounding VISITAX

Table of Contents

- 1 Clearing Up the Misinformation Surrounding VISITAX

- 2 What is VISITAX?

- 3 Who is Required to Pay VISITAX?

- 4 How much is the VISITAX?

- 5 How to Pay Your Quintana Roo VISITAX

- 6 Pay Your VISITAX via the QR Government Portal

- 7 Pay Your VISITAX via TravelKore

- 8 Enforcement and Compliance

- 9 Ambiguities in the Enforcement of VISITAX

- 10 What other taxes are travelers charged and how are they paid?

- 11 Additional Taxes in the State of Quintana Roo

- 12 VISITAX – Frequently Asked Questions

- 13 Why VISITAX?

This article was updated in April 2024 to reflect the most up-to-date tax rates and address some of the lingering questions about compliance and enforcement. This post is purely for informational purposes. None of the links in this article are affiliate links. Puerto Aventuras Living does NOT receive a commission from the collection of VISITAX from SATQ or TravelKore.

If you’re planning a trip to Quintana Roo, Mexico, you have probably heard something about the new tax you will be required to pay. Even if you are a regular visitor to the state, and have never paid before, it’s important to understand VISITAX, WHO has to pay it and HOW to pay it securely.

The following information will help you understand everything you need to know about this new international tourist tax payment and how to be sure you are in compliance when you are traveling to Quintana Roo.

What is VISITAX?

VISITAX is a new tourism tax implemented by the government of Quintana Roo in Mexico, aimed at international visitors, traveling to this region. When traveling to the state of Quintana Roo in Mexico, it is now mandatory to pay VISITAX and obtain a QR code as proof of payment. Quintana Roo is home to popular destinations such as Cancun, Isla Mujeres, Tulum and Playa del Carmen among others.

In 2021, the Mexican State of Quintana Roo introduced VISITAX, a new tax levied on international tourists. At the time, the region was still reeling from the economic effect of the shutdowns caused by the COVID-19 pandemic. This tax may have been initially conceived as a way to jump-start the reactivation of the tourism sector.

In December 2022, the Law of Rights of the State of Quintana Roo, article 51-octies was amended to make VISITAX mandatory for all international visitors.

The primary purpose of VISITAX is to bolster the maintenance and improvement of the state’s tourism infrastructure, aid in environmental conservation and create new tourist attractions. This initiative, more than a mere regulatory measure, is meant to foster significant efforts toward sustainable tourism in the Mexican Caribbean, one of Mexico’s most frequented areas.

VISITAX is a strategic measure to generate revenue that will be invested back into preserving and enhancing the region’s natural resources to maintain its appeal to foreign tourists.

The funds collected through VISITAX will be administered by the Quintana Roo tax Administration system (SATQ). Funds are being allocated to various projects aimed at improving tourist facilities, preserving the natural environment, and enhancing the overall visitor experience. This includes beach restoration projects, maintenance of public spaces, and development of local communities.

As the Cancun International Airport is one of the top ten busiest airports in the world, this new tourism tax should be a significant source of revenue to support a more sustainable tourism model in the region.

Travelers entering and departing the state through the other International airports in Quintana Roo, Cozumel, Tulum and Chetumal will also be expected to pay this exit tax.

Who is Required to Pay VISITAX?

VISITAX is a mandatory tax for all international visitors traveling to Quintana Roo. The eligibility criteria for paying this tax are straightforward. VISITAX applies to all foreign visitors who enter the state for tourism purposes. This includes travelers coming for leisure, business, or educational reasons.

There are notable exemptions to this rule. Mexican nationals living abroad, and foreigners who are temporary or permanent residents of Mexico are not required to pay VISITAX. No proof of residency is required as that information is already tied to your passport number. Welcome to the new digital age in Mexico.

Foreign tourists entering and departing Quintana Roo through the southern border of Belize are also exempt from VISITAX.

How much is the VISITAX?

Currently, the cost of VISITAX stands at 271 MXN per person. (April 2024)

This fee is a fixed rate, applicable to all international tourists visiting Quintana Roo. This rate will be subject to change based on governmental policies and economic factors.

How to Pay Your Quintana Roo VISITAX

There are two ways to pay your VISITAX; through the portal on the Quintana Roo State Government website or through TravelKore.

TravelKore is the ONLY third-party payment platform authorized by the Quintana Roo State Government to collect this new visitor tax. There is no additional cost to the end user.

Pay Your VISITAX via the QR Government Portal

The new payment system foreign tourists must use to pay VISITAX is a simple online process designed to be user-friendly and efficient. Your VISITAX can be made before or after entering the destination or during your stay. The payment verification will be made when you leave the state.

Enter the SAQT VISITAX website and fill out the application form with the following information:

- The date you will be departing Quintana Roo

- Number of people in your group

- First and last name of each person in your group

- Birthdate of each person in your group

- Passport number for each person in your group*

- A valid email address

* Each member of your group must have a valid Passport Book to enter Mexico by air. Passport cards are not permitted.

Once you have filled out the form, you will be redirected to a secure online payment page. Payments can be made using debit cards or credit cards. Accepted credit card companies include MasterCard, VISA, Discover and American Express.

This is a one-time payment and is valid for the entire period of your stay in Mexico.

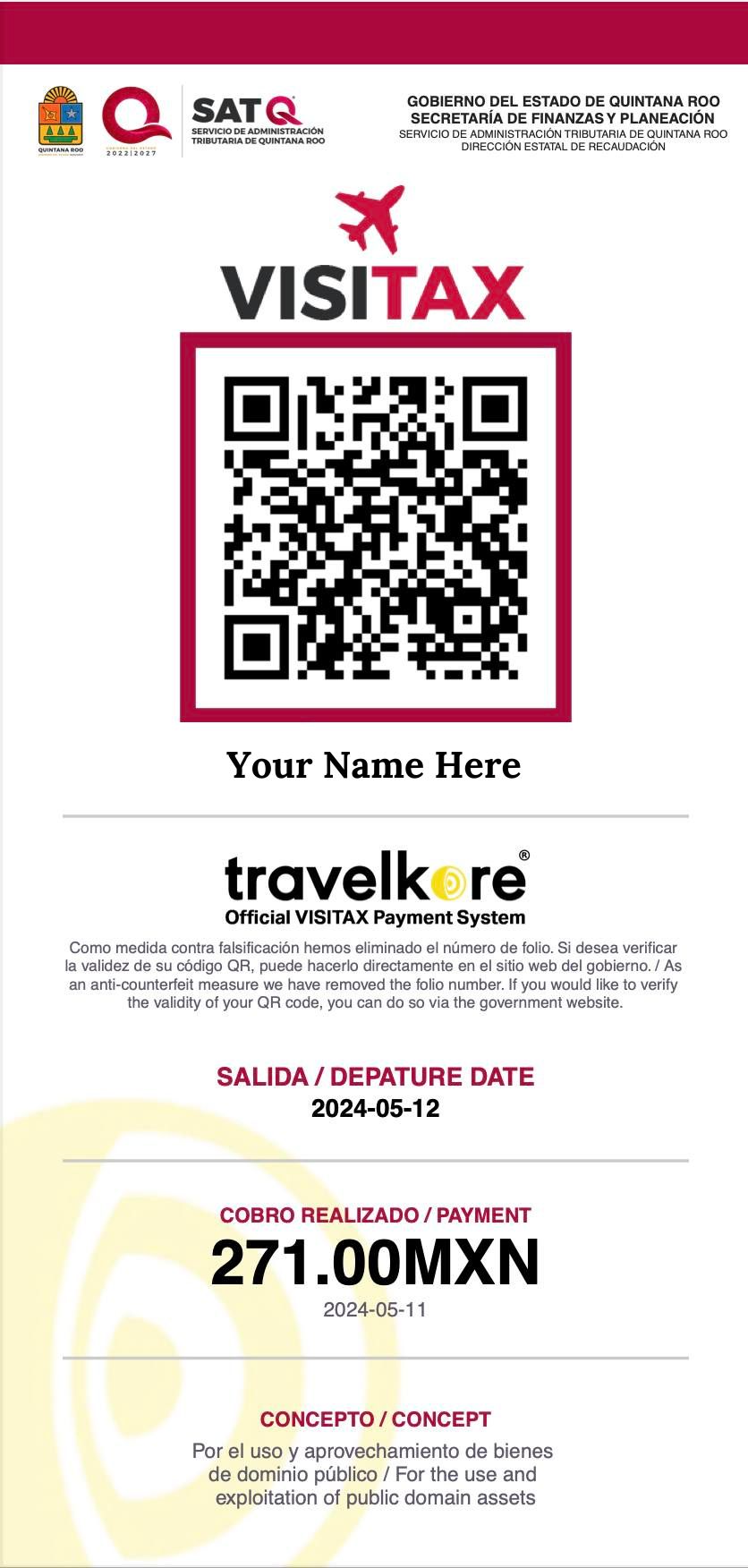

As soon as the payment is completed, you will be provided with a QR Code. This will serve as your proof of payment.

It is imperative to store your QR code safely on your cell phone or other other digital device. While there is no widespread enforcement of this new exit tax, some travelers have reported being asked to present their proof of payment.

Should you lose your QR code, don’t panic. Your travel information will be stored on the SATQ servers for up to one year.

The website has been reportedly “glitchy” so if you have any trouble you can reach out for support between the hours of 8:00 AM – 5:00 PM to the e-mail address [email protected].

Pay Your VISITAX via TravelKore

What is TravelKore?

TravelKore is an online payment option that has been contracted and authorized as a VISITAX collection agency by the Quintana Roo State government. TravelKore is the only third-party payment interface that has been authorized by the Quintana Roo State Tax Authority (SATQ) to collect VISITAX.

The TravelKore VISITAX payment interface is a web-based portal that you may safely use to pay your VISITAX. The process is designed to be seamless, with the QR code ensuring quick verification and a hassle-free experience for travelers. The online process is straightforward and your information is secure.

Enter the TraveKore website and provide the following information:

You have the option to pay in US Dollars, Canadian Dollars or Mexican Pesos.

Once the payment has been processed, your official government-issued QR code will be sent to you instantly via the provided e-mail.

TravelKore can process VISITAX QR codes for up to 10 persons with a single payment.

TravelKore has a Live Chat feature that you can use if you are having any difficulty with the process of applying or making the corresponding payment.

There are several optional services also available to TravelKore users including:

SafeKore (Travel Safety App) If you have provided your phone number on the VISITAX payment form, your unique QR code will be saved and viewable on this mobile app. If you are traveling with a group, you will not have access to other members in your party’s QR codes via this app due to privacy regulations

CareKore (Digital Health Wallet) If you set up a CareKore account, your QR code will be automatically added to your CareKore wallet and readily accessible on this web-based platform.

It’s crucial to keep a copy of the receipt and the QR code, stored digitally in multiple places. We recommend you also print a copy if possible. This code is your only proof of payment and MAY be required during your stay in Quintana Roo, especially at immigration checkpoints or by accommodation providers.

This is what your QR will look like when VISITAX is paid through Travelkore. It contains no personal information other than your name. When scanned by an official of the state or federation it will indicate the validity of the code.

If your QR code(s) is not delivered immediately via email, you may have used an unauthorized collection site. If you have paid more than CDN 22.50 or USD 17.00 you should contact the site you purchased the code from and request a refund immediately.

Avoid Fake VISITAX Websites

There are dozens of other websites purporting to be representatives of the QR State government agency and charging a service fee as high as 50 USD. The URLs (website addresses) they use are very convincing and include visitax.us, visitax.eu, visitaxqr.mx, visitaxmexico.mx, visitax-cancun.com, mexico-visitax.com, quintanarootax.com, visitaxgob.mx, visitaxmex.com among countless others.

You should avoid processing your VISITAX payment through any private website that is not unauthorized to collect VISITAX. Only pay your VISITAX fee using the government’s official website or Travel Kore.

Avoiding VISITAX Scams

To avoid VISTAX scams, please remember the following:

- You should never be requested to make a cash payment for VISITAX upon arrival at your destination.

- Under no circumstances should you be required to pay VISITAX in cash by anyone, even a government official.

- You should never be charged more than 271 MXN per person, including service charges or convenience fees. The only time this may differ is if you have specifically requested your licensed travel agent to make the payment on your behalf who may add a fee or charge a commission for the transaction.

What to Do If You Think You Have Been Scammed

If you think you have made a payment through a fraudulent site, follow these steps:

- Visit the government portal (https://www.visitax.gob.mx/sitio/busqueda.php) and check your payment status. If the search returns “no record found”, it means there is no official record of your VISITAX payment.

- Call your credit card company and dispute this charge.

- Repurchase your VISITAX through the proper channel https://www.visitax.gob.mx/sitio/

Enforcement and Compliance

While the tax was first implemented on April 1, 2021, until now there has been little or no oversight or enforcement. The state’s authorities are now working closely with travel companies, airlines, accommodation providers and professionals in the tourist industry to ensure that visitors are well-informed about VISITAX and its importance.

Until now, enforcement of VISITAX has been minimal. It seems this is about to change. Non-compliance with this exit tax can lead to several consequences for international travelers.

Compliance with VISITAX is monitored through a system integrated with travel and immigration entities. The importance of retaining the QR code cannot be overstated as it is essentially your “VISITAX Pass”. It serves as your official document verifying that you have complied with local regulations, ensuring a smooth and enjoyable visit to Quintana Roo and a seamless departure when you leave.

While specific penalties are yet unknown, in the future these may include fines or other legal repercussions, particularly when attempting to exit the state or country. You may even be detained by Mexican authorities.

Ambiguities in the Enforcement of VISITAX

There is still quite a bit of speculation and misinformation going around on Facebook and in online message boards such as TripAdvisor and Reddit. We have done the best we can to ask the right questions and get answers from reputable sources. To be fair, there are still a lot of unknowns.

Due to the lack of credible information, there has been a lot of push-back from travelers regarding the veracity of the new VISITAX, who is authorized to collect it and whether there will be any repercussions for non-compliance.

The lack of documentation and clear communication from the state government has left many travelers uncertain and has opened the door for a lot of speculation on the internet. The government’s unwillingness (or inability) to enforce the new tax has done nothing but enhance public distrust and help stir the pot in online forums.

Vague statements from VISITAX officials online have indicated that Mexican state authorities MAY ask tourists to present their VISITAX receipt (payment confirmation) upon arrival or at any time during their stay.

As VISITAX is an exit tax, it is not required by law to be paid until you exit the state of Quintana Roo. No one should be asking visitors to produce a receipt for payment until payment is due.

Cruise ship passengers on closed-loop itineraries with stops in Cozumel and Mahahual are questioning the requirement to comply with this new taxation. While the law specifies that ALL visitors to Quintana Roo are subject to this tax, those coming into the state on cruise ships are not subject to immigration screenings. As such, their passports will never be flagged either entering or exiting Quintana Roo.

Beginning in 2025 a new 5 USD Environmental Tax will be levied on all cruise ship passengers coming into QR. This is a new tax and unrelated to VISITAX. My somewhat educated guess is that both taxes will ultimately be included in the cost of any cruise with a port of call in Quintana Roo. Currently, there is no clear plan in place to confirm and enforce compliance.

The same holds true for foreign travelers who enter Quintana Roo by car, bus or even the new Tren Maya. Without immigration checkpoints and screening on the land borders with our neighbors Yucatan and Campeche, there is no way to check the tax status of travelers. By the letter of the law, those who have begun their Mexico journey in other states owe the tax but cannot be compelled to pay by threat of fine or other consequence.

Will any of this change in the future? We’ll keep you posted!

What other taxes are travelers charged and how are they paid?

In addition to VISITAX, travelers to Mexico also are levied the following taxes.

DNR or Mexican Tourist Tax

This is the Tourist Tax officially called “Derecho No Residente” (DNR) or “Derecho de No Inmigrante” (DNI). For visitors flying to Mexico, the tax is INCLUDED IN THE AIRFARE, so there’s nothing to pay at any airport. An itemized receipt issued by the airline shows the tax listed with all the other miscellaneous fees and taxes. It might be listed simply as “Visitor Tax” with the reference code “UK”.

Effective in 2023, the amount of the tax is 687 MXN (Mexican pesos), but it will be shown on the airline receipt in the same currency with which the airfare was paid. Expect this tax to increase in 2024.

Mexican International Airport Usage Tax

This tax must be paid by all visitors leaving Mexico at an international airport, but airlines have INCLUDED THE TAX IN THE AIRFARE, so there’s nothing to pay at any airport.

An itemized receipt from the airline shows the tax listed with all the other miscellaneous fees and taxes. It might be listed simply as “Departure Tax” and should have a code reference of “TUA” or “XD”.

This is an airport tax rather than a departure tax because it’s not paid if you are leaving Mexico at a land border. The tax amount varies according to the airport. For example, the tax is higher in Puerto Vallarta than it is in Cancun.

The amount is 623 MXN (Mexican pesos) per person or approximately 36 USD.

Additional Taxes in the State of Quintana Roo

Quintana Roo Environmental/Sanitation Tax

This tax is set by each municipality in the State of Quintana Roo and collected by the hotel/resort during check-in (or check-out in some cases).

Depending on the municipality, the amount is 20 to 70 MXN per night per room (or per person depending on the municipality). Currently in the municipality of Benito Juarez, where Cancun is located, the tax is 67.35 MXN per room per night. In other municipalities, the tax ranges from 20 to 30 MXN per room per night.

The state government recently announced that beginning in 2025, a 5 USD Environmental Tax will be levied on each cruise ship passenger whose itinerary includes a port of call in Quintana Roo. That charge will likely be included in the cost of the cruise when it is paid.

VISITAX – Frequently Asked Questions

VISITAX, while fairly straightforward, has given rise to many questions and misconceptions. Here are some common questions addressed:

How much does VISITAX cost?

- VISITAX is currently 271 MXN. (April 2024)

Is a printed copy of the VISITAX receipt required?

- While a print copy is not mandatory, we recommend having a printed copy of the VISITAX receipt along with the digital receipt stored in your phone or other device. The receipt will have a QR code that may be required for verification.

Is VISITAX applicable only to certain nationalities?

- VISITAX applies to ALL international visitors, regardless of nationality who are not exempted by legal immigration status in Mexico.

Who is exempt from paying VISITAX?

- Mexican Nationals

- Temporary and Permanent Residents of Mexico

- Persons entering Quintana Roo from Belize through the southern border

Is the new VISITAX included in the cost of my flight?

- No. No airline or travel company is including VISITAX in the cost of the airfare.

Is there a place to pay VISITAX at the Cancun Airport?

- No, VISITAX cannot be paid at the Cancun International Airport. VISITAX may only be paid online up to one year before your departure date.

Does VISITAX vary depending on the length of stay?

- The fee is a fixed rate per person per visit, regardless of the duration of your stay.

How long am I allowed to stay in Quintana Roo?

- The maximum stay in Mexico for a foreign tourist without immigration status is 180 days.

Is VISITAX included in the airline ticket price?

- VISITAX is not included in airline ticket prices and must be paid separately.

Are there exemptions for certain travelers?

- Yes, Mexican nationals, temporary and permanent residents of Mexico are exempt.

- Foreigners entering and exiting Quintana Roo through the Belize border are also currently exempt regardless of nationality.

What if I travel to multiple destinations in Quintana Roo?

- The VISITAX is a one-time tax regardless of multiple destinations within the state.

What if I travel to multiple destinations in Mexico?

- If you enter Mexico at any international airport in the state of Quintana Roo, VISITAX must be paid regardless of which airport you use to exit the country.

Do I have to pay VISITAX if I fly into the island of Cozumel?

- Yes, VISITAX must be paid by any foreign tourist flying into the Cozumel airport as well as the International Airport in Chetumal and the new airport in Tulum.

What happens if VISITAX is not paid?

- Failure to pay VISITAX may result in fines or penalties. It is a legal requirement, and non-compliance can lead to complications during your stay or upon departure.

Is VISITAX refundable if my trip is canceled?

- VISITAX is generally non-refundable.

Why VISITAX?

As destinations like Cancun, Playa del Carmen, and Tulum have experienced a surge in tourism, the impact on local resources and infrastructure has become increasingly evident. VISITAX is a response to these challenges, aiming to preserve the natural beauty and cultural integrity of Quintana Roo for future visitors.

Quintana Roo’s state tourism tax aligns with other global, “responsible tourism” practices, emphasizing the importance of sustaining the region’s natural and cultural treasures. For travelers, contributing to VISITAX is not just about adhering to regulations; it’s an investment in preserving the allure and charm of Quintana Roo.

We would like to hear your feedback as VISITAX is finally implemented in the airports of Quintana Roo. Please tell us about your experiences in the comments below.

Related Articles:

How to Get to Puerto Aventuras from the Cancun Airport

Thank you for sharing. I hadn’t heard about this. It seems like many countries are starting to implement a tourist tax.

I think may countries already have them. Mexico does. This one is specific to the state of Quintana Roo only which makes it even more interesting.

I had no idea about this! So glad I know in advance!

I hadn’t heard about the visitax before, but I hope it helps in preserving the nature and culture in Quintana Roo. Great information, especially about the fake sites. I’m curious about why you don’t have to pay visitax if you leave via the Belize border.

I think because hundreds of Belizians come across the border every day to work. But that’s just a guess.

Have tourists been properly informed about the new VISITAX and its implications before arriving in Quintana Roo, Mexico?”,

“refusal