The current status of CIBanco and how to retrieve funds from your account.

Table of Contents

- 1 The current status of CIBanco and how to retrieve funds from your account.

- 2 What This Means for Account Holders

- 3 Steps Account Holders Need to Take

- 4 Steps to File a Payment Request with IPAB (for CIBanco Depositors)

- 4.1 1. Wait until the “Portal de Pagos IPAB” is activated

- 4.2 2. Register in the Portal using your personal and account information

- 4.3 3. Provide a destination bank account (CLABE) for payment

- 4.4 4. Wait for confirmation and disbursement

- 4.5 5. If you don’t get paid or disagree with the amount

- 4.6 Sources

As many of you have likely heard, CIBanco’s long-running troubles have come to a head. What began as a promising institution specializing in foreign exchange and trust management has now ended in a full liquidation following U.S. money-laundering allegations and regulatory intervention in Mexico.

Understandably, many account holders, especially those with fideicomisos or savings accounts, are anxious about what happens next and how to recover their funds.

Below is a clear overview of how we got here, what steps the government has taken, what’s next for CIBanco account holders, and most importantly, what you need to do to retrieve your money safely through IPAB, Mexico’s bank deposit protection agency.

Origins and Business Growth

CIBanco (CI Banco S.A.) began as a foreign exchange house in 1983 and later expanded into full banking. In 2008 it gained authorization to operate as a multiple banking institution. Over time it became known for managing trust operations and specialized financial products.

In June 2025, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) designated CIBanco, along with Intercam and Vector Casa de Bolsa, as institutions of primary money laundering concern, alleging they facilitated illicit transactions tied to drug cartels and procurement of fentanyl precursor chemicals.

As a result, the U.S. prohibited transactions between U.S. financial institutions and CIBanco. Visa, for example, unilaterally suspended international transactions on CIBanco cards in response.

Regulatory Intervention in Mexico

On June 26, 2025, Mexico’s financial regulator (CNBV) and other authorities intervened and took temporary managerial control of CIBanco (and Intercam) to protect clients and stabilize operations.

Because of the U.S. sanctions, many real estate trusts (fideicomisos) immediately removed CIBanco as trustee to avoid complications.

Mexico temporarily transferred CIBanco’s trust operations to state development banks, so essential trust functions could continue. Mexico’s Finance Minister confirmed that the takeover was temporary and managerial, intended to protect depositors. He said account holders’ funds are “absolutely safe.”

Ultimately, the reputational damage and the removal of fiduciary roles by clients weakened CiBanco’s business base beyond redemption.

The broader Mexican banking system remains operational and stable.

License Revocation and Liquidation

On October 10, 2025, Mexican authorities revoked CIBanco’s federal banking license, signaling the start of its liquidation.

Officials announced that IPAB (the Bank Deposit Protection Institute) would begin processing payouts for insured deposits starting October 13.

As part of the liquidation, all regular banking operations are winding down, though existing loan payments and obligations are still recognized.

What This Means for Account Holders

Deposit Insurance: What You’re Protected For

Mexico has a legal deposit insurance system managed by IPAB (Instituto para la Protección al Ahorro Bancario). Think of this as the FDIC of Mexico.

Under the law, insured deposits (in authorized banking products) are guaranteed up to 400,000 UDIS (Unidades de Inversión). That amount currently translates to approximately 3,424,000 pesos (roughly 3.4 million pesos).

Deposits belonging to shareholders, top executives, or funds excluded under the law are not covered.

Steps Account Holders Need to Take

Submit a payment claim to IPAB

Once IPAB publishes the liquidation resolution, you’ll need to file a payment request for your insured deposit. This includes documents proving your account and account balance.

Bank will deposit the funds into another account

You may need to provide a different bank/account to receive the compensation if your CIBanco account is closed. It’s important to confirm with your recieving bank how the funds will be handled and if they will be made available to you immediately.

For balances beyond the insured limit

If your deposit exceeds the 3.4 million pesos limit, you are considered an unsecured creditor for the excess. You may need to file a lawsuit or claim in liquidation to recover the remainder. Whether you recover anything depends on how many assets remain and how creditors rank.

Be patient—these are slow processes

Liquidation, claims validation, and distribution can take months or even longer. Experts warn it could take 3 to 6 months or more.

Consult a lawyer if needed

Especially if you have amounts above the insured limit, you may want legal help to navigate creditor rights.

Steps to File a Payment Request with IPAB (for CIBanco Depositors)

When CIBanco’s license was revoked and liquidation began, IPAB opened the path for account holders to claim their insured deposits.

Below are the known steps and tips so far:

1. Wait until the “Portal de Pagos IPAB” is activated

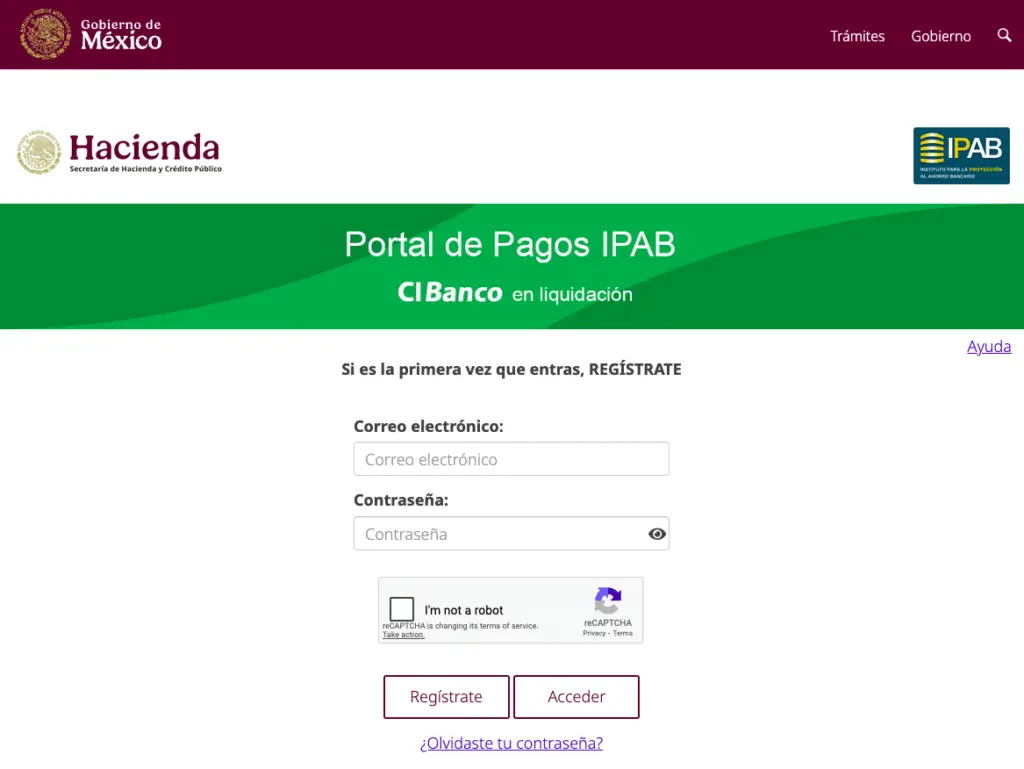

- IPAB announced that from October 13, 2025, the procedure to claim deposits would begin via their “Portal de Pagos” (Payment Portal).

- The portal will be accessible via the IPAB website (gob.mx/ipab) or a sub-portal dedicated to the CIBanco claim.

2. Register in the Portal using your personal and account information

To file your request, you must fill out the online form with information exactly as it appears in your last account statement from CIBanco. Required details generally include:

- Your full legal name (Enter XXXX if you do not have a second last name)

- Your contact email

- Your phone number

- The bank account number(s) you held at CIBanco (with correct digits)

- Your last account statement balance(s)

During registration you may be asked for proof of identity (e.g. official ID) and matching details from statements to confirm you were indeed the account owner.

3. Provide a destination bank account (CLABE) for payment

When completing your claim, you will need to supply a CLABE (bank account in another institution) where IPAB can transfer your insured deposit. It must be an account in a participating Mexican multiple bank.

4. Wait for confirmation and disbursement

- After submitting your claim, IPAB sends a confirmation email the same day your registration is accepted.

- If your claim is valid and everything checks out, you should receive the payment, typically by electronic transfer to your nominated account. In some cases (especially for smaller amounts), a check may be sent.

- IPAB’s rules say payouts for “obligations guaranteed” should be done within 90 calendar days from when the bank enters liquidation.

5. If you don’t get paid or disagree with the amount

- If your claim is not processed or the amount offered is incorrect, you can submit a formal “solicitud de pago” (request for payment) after verifying why there is a discrepancy.

- The deadline to submit that request is one year from the date CIBanco entered into liquidation.

- For amounts above the insured limit (400,000 UDIS, approx. 3.4 million pesos), you may need to assert rights as an unsecured creditor and potentially pursue legal action against the liquidation estate.

The fall of CIBanco has shaken confidence and created real concern among clients. It’s important to remember that insured deposits are protected by Mexican law and the broader Mexican banking system remains operational and stable.

The process will take time, but IPAB has already activated its payment portal and is responsible for ensuring eligible customers are repaid.

Patience will be key in the months ahead, but the system is designed to safeguard depositors and prevent broader instability.

If you or someone you know held accounts with CIBanco, follow the outlined steps carefully and monitor official IPAB announcements for updates.

Sources

- El País — “Las autoridades mexicanas revocan la licencia y liquidan a CIBanco, señalada por Estados Unidos por presunto lavado de dinero para el narco.” October 10, 2025. https://elpais.com/mexico/2025-10-10/la-autoridades-mexicanas-revocan-la-licencia-y-liquidan-a-cibanco-senalada-por-estados-unidos-de-presunto-lavado-de-dinero-para-el-narco.html

- El Economista — “Liquidación de CIBanco: proceso y requisitos para reclamar tus ahorros ante el IPAB.” October 10, 2025. https://www.eleconomista.com.mx/finanzaspersonales/liquidacion-cibanco-proceso-requisitos-reclamar-tus-ahorros-ipab-20251010-780979.html

- El CEO — “IPAB inicia liquidación de CIBanco: este es el proceso para que los clientes recuperen sus ahorros.” October 10, 2025. https://elceo.com/negocios/ipab-inicia-liquidacion-de-cibanco-este-es-el-proceso-para-que-los-clientes-recuperen-sus-ahorros

- Mexico News Daily — “Visa suspends international transactions on CIBanco cards.” June 27, 2025. https://mexiconewsdaily.com/business/visa-suspends-international-transactions-cibanco-cards

- Gobierno de México – IPAB — Official site for insured deposits and payout procedures. https://www.gob.mx/ipab

- Gobierno de México – IPAB — FAQs for depositors. https://www.gob.mx/ipab/acciones-y-programas/preguntas-frecuentes-ahorradores

- Gobierno de México – IPAB — Information page for CIBanco depositors. https://www.gob.mx/ipab/articulos/informacion-para-el-publico-ahorrador-de-cibanco

- CNBV (Comisión Nacional Bancaria y de Valores) — Official bulletins on intervention and license revocation. https://www.gob.mx/cnbv